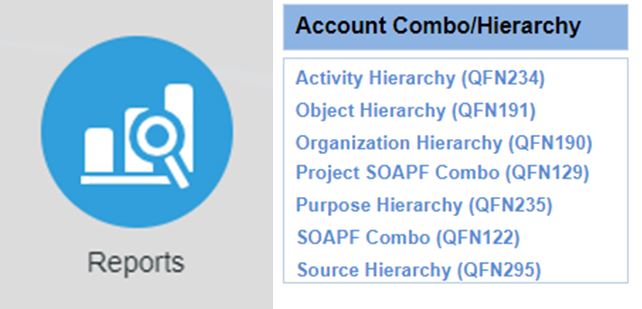

The information that was available on this webpage, is available in Quantum Financials – Reports

A Division of Administration and Finance

Help

Contact

Office of the Controller

220 Arch St.

13 floor (Office level 2)

Baltimore, MD 21201